Saudi Printing and Packaging Co. (TADAWUL:4270) Buyers Are Much less Pessimistic Than Anticipated

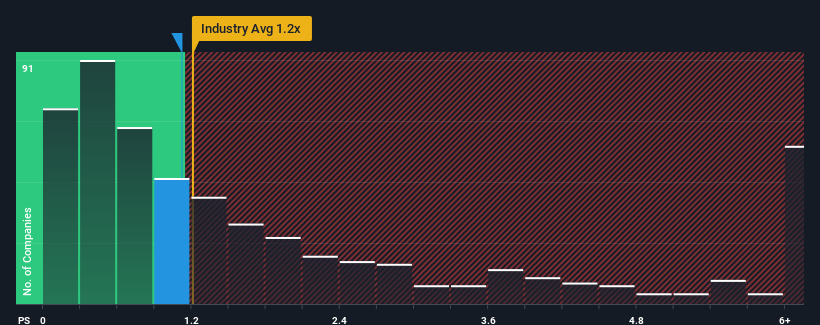

With a median price-to-sales (or “P/S”) ratio of near 1.4x within the Industrial Providers trade in Saudi Arabia, you may be forgiven for feeling detached about Saudi Printing and Packaging Co.’s (TADAWUL:4270) P/S ratio of 1.1x. Whereas this won’t elevate any eyebrows, if the P/S ratio isn’t justified traders might be lacking out on a possible alternative or ignoring looming disappointment.

See our newest evaluation for Saudi Printing and Packaging

What Does Saudi Printing and Packaging’s P/S Imply For Shareholders?

As an illustration, Saudi Printing and Packaging’s receding income in current occasions must be some meals for thought. It may be that many count on the corporate to place the disappointing income efficiency behind them over the approaching interval, which has stored the P/S from falling. If you happen to like the corporate, you’d no less than be hoping that is the case in order that you may probably decide up some inventory whereas it isn’t fairly in favour.

Need the complete image on earnings, income and money circulate for the corporate? Then our free report on Saudi Printing and Packaging will allow you to shine a light-weight on its historic efficiency.

How Is Saudi Printing and Packaging’s Income Progress Trending?

The one time you would be snug seeing a P/S like Saudi Printing and Packaging’s is when the corporate’s development is monitoring the trade intently.

In reviewing the final yr of financials, we have been disheartened to see the corporate’s revenues fell to the tune of 14%. A minimum of income has managed to not go utterly backwards from three years in the past in mixture, due to the precedent days of development. Subsequently, it is honest to say that income development has been inconsistent just lately for the corporate.

Evaluating the current medium-term income tendencies towards the trade’s one-year development forecast of 15% reveals it is noticeably much less engaging.

With this info, we discover it attention-grabbing that Saudi Printing and Packaging is buying and selling at a reasonably comparable P/S in comparison with the trade. It appears most traders are ignoring the pretty restricted current development charges and are prepared to pay up for publicity to the inventory. Sustaining these costs will probably be tough to realize as a continuation of current income tendencies is more likely to crush the shares ultimately.

The Key Takeaway

Typically, our desire is to restrict using the price-to-sales ratio to establishing what the market thinks concerning the total well being of an organization.

Our examination of Saudi Printing and Packaging revealed its poor three-year income tendencies aren’t leading to a decrease P/S as per our expectations, given they give the impression of being worse than present trade outlook. Proper now we’re uncomfortable with the P/S as this income efficiency is not more likely to assist a extra optimistic sentiment for lengthy. Except there’s a important enchancment within the firm’s medium-term efficiency, it will likely be tough to forestall the P/S ratio from declining to a extra cheap stage.

The corporate’s steadiness sheet is one other key space for threat evaluation. Our free steadiness sheet evaluation for Saudi Printing and Packaging with six easy checks will will let you uncover any dangers that might be a problem.

If these dangers are making you rethink your opinion on Saudi Printing and Packaging, discover our interactive listing of top quality shares to get an thought of what else is on the market.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Saudi Printing and Packaging is probably over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to deliver you long-term targeted evaluation pushed by elementary knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.