Sun Hing Printing Holdings (HKG:1975) Dividend will be reduced to HK$0.043

Sun Hing Printing Holdings Limited (HKG:1975) announced on the 20th of Decembre that it would pay a dividend of HK$0.043. This is a decrease from the dividend paid last year. The 8.3% dividend yield remains within the range expected for the industry.

Check out our latest analysis for Sun Hing Printing Holdings

Sun Hing Printing Holdings’ Payment Has Solid Earnings Coverage

Dividend yields that are high and sustainable are great. Sun Hing Printing Holdings dividend had been comfortably covered by cash flow and earnings prior to the announcement. This means that a substantial portion of earnings is invested back into the company.

If the current trends continue, EPS will grow by 50.7% in the coming year. If the dividend follows the current trend, the payout ratio should be around 32% next year. This is a range that’s pretty sustainable.

Sun Hing Printing Holdings’ Dividend Has Lacked Consistency

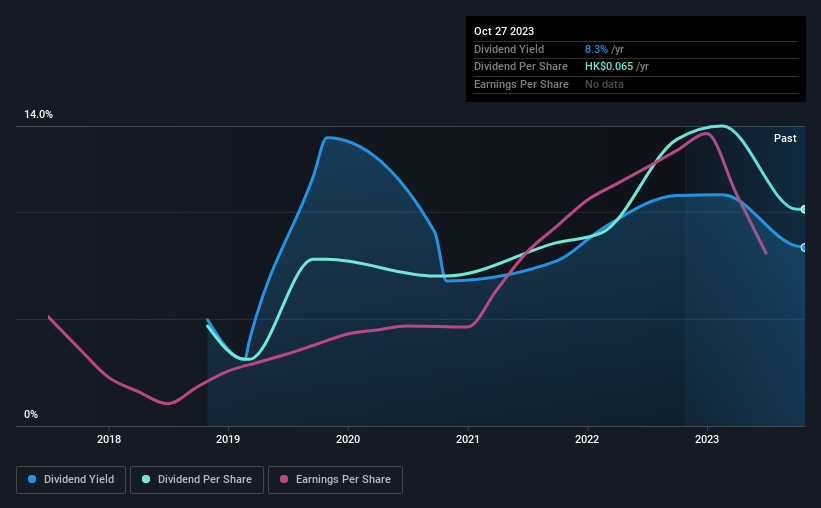

Sun Hing Printing Holdings is paying a regular dividend, though it has cut the amount at least one time in this period. The fact that the company has cut the dividend once does not mean it will do so again in the future. Dividends have increased from HK$0.03 per year in 2018 to HK$0.065 for the latest total payment. It has grown its dividends by 17% annually over the last five years. Dividends are up rapidly, but we’re not sure that the stock will continue to be a reliable income source in the future.

Dividends Look Likely to Grow

When the dividend is unstable, it’s more important than ever to determine if earnings are growing. This could be a sign of a rising dividend in future. Sun Hing Printing Holdings impressed us with its 51% annual growth in EPS over the last five years. Sun Hing Printing Holdings’ earnings per share have grown in recent years. It also has a healthy balance between dividends and reinvesting.

Sun Hing Printing Holdings – Dividends We Like!

Sun Hing Printing Holdings is a company that has all the ingredients for a strong income stock. We don’t expect this to happen very often or at all. Reducing the dividend will take pressure off the balance, which may help to ensure that the dividend is consistent in future. In light of all these factors, we believe this company has a solid future as a dividend-paying stock.

Investors will be more confident in companies with a consistent policy than those who have an unpredictable one. Nevertheless, our readers must also consider other factors before investing their money in a particular stock. We’ve taken the discussion a step further and identified Sun Hing Printing Holdings: 2 warning signs Investors need to keep this in mind as they move forward. Sun Hing Printing Holdings may not be the right investment for you. Check out our Top dividend stocks for your consideration

We make valuation simple.

Check to see if you qualify Sun Hing Printing Holdings Our comprehensive analysis includes Dividends, insider trading, financial health, and risks are all part of the fair value estimations.

See the free analysis

Do you have feedback about this article? Do you have any concerns about the article’s content? Get in touch Contact us today. Alternatively, email editorial-team (at) simplywallst.com.

This article is general. Our articles are not financial advice. We only provide unbiased commentary based on historical information and analyst predictions. It is not a recommendation that you buy or to sell a particular stock. Nor does it take into account your financial or personal situation. We strive to deliver you fundamentally-driven, long-term analyses. Our analysis may not take into account the latest qualitative material or announcements by companies that are price sensitive. Simply Wall St does not hold any of the stocks mentioned.